Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Growth Equity: The Child Prodigy of Private Equity and Venture Capital, or an Artifact of Easy Money?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Over the past few decades, growth equity (GE) has gone from an afterthought to a major asset class for huge investment firms.

Some argue that GE offers the best of both worlds: the opportunity to fund innovation and growth – as in venture capital – plus the ability to limit downside risk and invest in proven companies – as in private equity .

Others would counter that growth equity’s rapid ascent was mostly due to the easy money that persisted between 2008 and 2021.

With interest rates at ~0%, funds inevitably flowed into anything with “growth” in the name – regardless of its real growth potential:

What is Growth Equity?

Growth Equity Definition: In traditional growth equity, firms invest minority stakes in companies with proven business models that need the capital to expand; some firms also use “growth buyout” strategies, which are like traditional leveraged buyouts but with higher growth potential.

Most of the confusion around “growth equity” comes from the fact that it includes two different strategies, and many top firms use both.

Here are the main differences:

- Strategy #1: “Late-Stage Venture Capital” – This is what most people think of as “growth equity.” This style is about purchasing minority stakes in cash-flow-negative-but-high-growth companies that want to scale and eventually go public or sell (think: Uber or Airbnb before their IPOs). Valuations are high, the returns depend on future growth, and deals are for primary capital , i.e., new cash the business needs. There’s usually a long list of previous VC investors as well.

- Strategy #2: “Growth Buyouts” – This strategy is more like traditional leveraged buyouts because the PE firm acquires a much higher percentage of the company (or even majority control). Most companies are already profitable, the potential returns are lower, and there’s usually a large secondary component (i.e., the Founders sell some shares to take money off the table, but “the company” doesn’t get any of that cash). Debt financing is much more common, and the GE firm is often the first institutional investor.

Over time, many traditional growth equity firms have shifted to the “growth buyout” category as their assets under management have grown.

Most of this guide deals with the “late-stage VC” strategy, as dozens of other articles cover private equity strategies such as leveraged buyouts and traditional private equity .

The Top Growth Equity Firms in Each Category

If you asked the average person to name the “top” growth equity firms, you’d probably get a list like the following:

But there’s a bit more subtlety because these firms operate in different categories:

1) Primarily Late-Stage VC Deals – Examples include a16z Growth, Battery, Bessemer, Sequoia Growth, and Technology Crossover Ventures (TCV).

Most of these firms started out doing early-stage VC deals and still invest across all company stages.

2) Primarily Growth Buyout Deals – Firms like Accel-KKR, Great Hill, Mainsail, PSG, Spectrum, and TA Associates go here.

Many of these firms use debt to fund deals, and they complete bolt-on acquisitions for portfolio companies.

3) Mix of Late-Stage VC and Growth Buyout Deals – General Atlantic, Insight, JMI, Stripes, and Summit are good examples.

4) Private Equity Mega-Funds with Growth Teams – TPG Growth is the most famous example, but you could also add the growth teams at Advent, Bain, Blackstone, Permira, Providence, and Warburg Pincus (note that these are not all “ mega-funds ” according to our definitions).

You could keep going and add plenty of names.

For example, Susquehanna Growth Equity is another great firm, but it doesn’t use the traditional LP/GP structure, so I’m not sure where it fits in.

Similarly, SoftBank has played a big role in growth equity (for better or worse…) but it’s the investing arm of a corporation, not a standalone PE/VC firm.

Many other well-known VCs have also raised growth equity funds, including Benchmark, Kleiner Perkins (KPCB), and NEA.

Why Did Growth Equity Get So Popular?

The main factors were:

- The Rise of Tech and Software – Since so many growth equity deals involve technology, the sector’s rise over the past 10 – 20 years also drove a lot of growth equity investing.

- Companies Began Staying Private for Longer – A long time ago, startups went public within a few years of raising VC funds (see Google , Cisco, etc.). In the 2010s, startups began to postpone their IPOs, but they still needed funding.

- Tech Industry Maturation – As the technology industry matured, companies generated more predictable cash flow, but they still needed capital to scale.

- Loose Monetary and Fiscal Policy – The quantitative easing (QE) and zero-interest-rate policies (ZIRP) that existed in most countries between 2008 and 2021 spurred a lot of “growth investing,” as established/sleepy firms like Fidelity suddenly became interested in riskier investments. Many hedge funds also joined the party.

From a career perspective , growth equity appealed to many bankers and consultants who didn’t want to be “pigeonholed” in venture capital (limited exit opportunities) or suffer through “banking hours” once again in private equity.

Growth equity offered a compromise: Modeling and deal work, networking, and shorter hours than most PE roles.

Growth Equity vs. Venture Capital vs. Private Equity

This section will focus on Strategy #1 (Late-Stage VC Investing) because Strategy #2 is nearly the same as what most middle-market private equity firms do, but with higher-growth companies.

Official descriptions usually cite the following points to explain how growth equity firms differ from VC and PE firms:

- They acquire minority stakes in companies (like VC and unlike PE).

- They invest in revenue-generating companies with proven business models (like PE and unlike early-stage VC).

- They aim for cash-on-cash multiples between 3x and 5x rather than the 5x, 10x, or 100x that VCs target and the 2x – 3x that many PE firms target. The targeted IRR might be in the 30 – 40% range.

- They earn returns primarily from growth via acquisitions and organic sources.

- They do not use debt since they only make minority-stake investments. However, they often invest using preferred stock with liquidation preferences attached to limit their downside risk (similar to VCs).

- The average deal size is bigger than early-stage VC but smaller than many PE deals; the $25 – $500 million range might be the norm for U.S.-based firms.

- The main risk factor in deals is executing the growth plan, not default risk due to debt (PE) or product/market risk (VC).

Growth equity firms could invest in any industry but tend to be skewed toward technology and TMT , with some exposure to consumer/retail , healthcare , and financial services .

The specific growth strategies used by portfolio companies could include almost anything, but a few common ones are:

- Paying for employees, buildings, and equipment to enter new geographies or markets.

- Developing new products or services.

- Scaling a company’s sales & marketing by hiring more sales reps.

- Completing bolt-on acquisitions that will boost the company’s revenue and cash flow.

On the Job: Growth Equity Careers

Unsurprisingly, growth equity careers are a mix of private equity careers and venture capital careers .

Let’s run down the average tasks an Analyst or Associate completes each day at a “Late-Stage VC” firm to demonstrate this:

- Sourcing: As in VC careers, there’s a lot of emphasis on “sourcing” or finding new companies to invest in (read: cold calling and emailing). Deals and business strategies are less complicated than in PE, so finding great companies is a competitive advantage.

- Financial Modeling: Like private equity, 3-statement models are common, as are valuations and DCF models , but LBO models are less common since not all deals use debt. Like venture capital, cap tables , liquidation preferences, and primary vs. secondary purchases come up frequently (plus, SaaS metrics , SaaS accounting , the Rule of 40 , and so on).

- Portfolio Companies: You probably won’t interact with management teams quite as much because your firm won’t own controlling stakes in all its portfolio companies. You may still help with operational issues, but it’s harder to “force” companies to change in a specific way.

- Due Diligence: For similar reasons – minority stakes rather than control deals – you won’t devote quite as much time and effort to due diligence in deals.

If you do the math, you’ll see that something doesn’t add up because the modeling, deals, and due diligence are less intense than in PE, but you also work longer hours than in VC (50 – 60 hours per week up to 70 – 80 when a deal is closing).

What accounts for the difference?

At some firms, the answer is “a lot more sourcing.”

But at other firms, you might spend more time on market/industry research or get more involved with portfolio companies.

The overall career path, tiles, and promotion times are like the private equity career path , but compensation is usually lower (see below).

Growth Equity Recruiting: Who Gets In, and How Do They Do It?

The recruiting differences vs. other fields of finance are as follows:

1) Candidate Pool: Growth equity is open to a wider pool of candidates than PE roles, but not as many as VC roles. Many people still get in from investment banking and management consulting , but some also get in from VC and finance-related jobs at startups. Also, you can get in more easily from a middle-market or boutique bank .

That said, you are still highly unlikely to win growth equity offers from something like engineering at a tech company or brand advertising.

Even product management is questionable – it can work for VC roles, but probably not for GE since you need more technical skills.

Finally, you can get into GE directly out of undergrad, but it’s less common than in IB/PE, and it’s not necessarily recommended because many of these roles are “sourcing heavy.”

2) Process: At most firms, the process is closer to off-cycle private equity recruiting , where you must proactively network to find roles. The biggest GE firms and the PE mega-funds still use on-cycle recruiting, but

3) Technical Skills: People often claim that growth equity interviews are “less technical,” but this is not universally true. You could easily get asked to complete an LBO modeling test, a 3-statement model, or a DCF, and standard IB interview questions and VC interview questions could come up.

Obviously, you’ll need these technical skills if you join a team that does “growth buyout” deals.

But even if you apply to a late-stage VC team, they might still give you a modeling test to weed out candidates .

Growth Equity Interviews and Case Studies

The main question categories in interviews are:

- Fit/Background – Expect to walk through your resume , explain “why growth equity,” why this firm, your strengths and weaknesses , and so on.

- Technical Questions – Everything is fair game (see above).

- Deal/Client Experience – You should review your 2-3 best deals and say whether you would have done each one, with “growth” as the key criterion.

- Firm/Portfolio Knowledge – You need to know the firm’s investment thesis, strategies/verticals, and have a rough idea of its portfolio companies. To save time, focus on 1-2 specific companies and do enough research to discuss them in-depth.

- Industry/Market Discussions – Rather than trying to “learn” the entire SaaS, AI, or hardware market, focus on one specific vertical (e.g., the top 2-3 companies, your #1 investment pick, the growth drivers, the risk factors, and the overall outlook).

- Mock “Sourcing” Calls – The firm could also ask you to role-play a call with a prospective portfolio company by introducing yourself, asking key questions, and requesting a follow-up conversation.

- Case Studies – Most GE case studies are either 3-statement modeling variants or open-ended market-research case studies, but anything is fair game ( paper LBO models , simplified or full LBO models, etc.).

An open-ended case study might give you a few pages of information on a company and ask you to draft an investment recommendation.

To do this, you will have to research the company’s market size, competitors, growth strategies, and strengths/weaknesses.

We don’t have a direct example here, but the VC case study on PitchBookGPT gives you a flavor of what to expect in a qualitative case.

For a modeling example, see our growth equity case study based on Procyon SA .

Compensation and Exits

These two points depend on whether you worked on growth buyouts or late-stage VC investments .

In growth buyout teams/firms, compensation at larger firms is generally a 15 – 20% discount to private equity compensation.

So, if an “average” PE Associate earns $300K – $350K in total compensation, the average range might be closer to $250K – $300K at a growth buyout firm.

However, note that the mega-funds might still pay about the same because they may align compensation across groups.

If you work for a smaller, late-stage VC fund, expect compensation closer to normal VC levels (maybe the $200K – $250K range, though it’s hard to find specific data here).

Fund sizes are smaller, portfolio company exits takes more time, and performance is less predictable, all of which account for the lower pay.

On the other hand, some firms pay “sourcing bonuses” if you contact enough companies, and they may offer co-investments in certain details, so there are ways to increase your pay as well.

As far as exit opportunities , you could move into standard private equity if you worked on growth buyouts, but this is much more challenging coming from a late-stage VC role.

Other opportunities include other GE firms, VC roles, startups/portfolio companies, or an MBA.

You wouldn’t be the best candidate for most hedge fund roles (traditional PE is better), but corporate development might be possible, especially if you had IB experience before entering growth equity.

Pros and Cons of Growth Equity and Final Thoughts

Summing up everything above, here’s how you can think about growth equity:

- It’s more accessible than traditional private equity roles.

- You potentially make a high impact from day one since much of the job involves finding new companies to invest in.

- You work with more “exciting” companies since your goal is to find and accelerate growth.

- Compensation is solid , especially in growth buyout teams, though it is usually a discount to traditional PE (albeit with better hours).

- There’s a good mix of exit opportunities spanning VC, PE, and operational roles.

- Some firms require extensive sourcing , including pressure to meet specific call targets, which many people do not like.

- You have limited control over portfolio companies due to the minority stakes, which means you can’t necessarily “change” specific things.

- It doesn’t necessarily offer a net advantage over joining a traditional VC or PE firm because each benefit has a drawback (e.g., shorter hours but lower compensation).

- Growth equity is highly cyclical – more so than early-stage VC or traditional PE – since late-stage funding tends to dry up quickly in down markets.

The last two points here are the most serious ones.

Even in a terrible market, plenty of early-stage VC deals still happen because people are always starting companies.

And while PE firms are less active in poor markets, they can still work on their portfolio companies, make add-on acquisitions, and pursue asset sales or divestitures .

By contrast, many growth equity firms get stuck in “no man’s land” because they write large checks but may not have majority control to implement big changes.

Growth buyout teams get around this issue if they do > 50% deals, but in many cases, you’d be better off going to a traditional PE firm first to gain a broader skill set.

If you like it, you can always shift to GE or VC afterward, as it’s much easier than the reverse move.

That said, growth equity can still be great for the right person – if you understand that combining two industries means you get the best and the worst of each one.

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

2 thoughts on “ Growth Equity: The Child Prodigy of Private Equity and Venture Capital, or an Artifact of Easy Money? ”

hi Brian what would you choose between a DCM offer of a MM bank and a growth equity fund offer on a LMM/MM company if traditional PE is the end goal?

Probably growth equity because DCM is not relevant to PE roles and tends to be quite bad for exit opportunities in general.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Master Cap Tables and Startup Modeling

Learn VC and growth equity financial modeling via 5 short case studies and 4 extended case studies on everything from AI to SaaS to biotech.

Real-Life Growth Equity Case Study: Example and Tutorial

Welcome to another tutorial video! This time we’re going to be going over a simple example of a growth equity case study. It’s not a step-by-step walkthrough, but I’ll be showing you some of the highlights and important points to focus on. You can find all the files and resources at mergersandacquisitions.com.gr – Equity Case Study.

Growth equity is a mix between private equity and venture capital. In growth equity, firms tend to invest minority stakes in companies and do not use debt for investments. The companies in growth equity need to have proven markets and business models, and the investment is used for specific growth-oriented purposes.

In growth equity case studies, you can expect to see similarities with venture capital case studies, such as questions about ownership and capitalization tables. However, you are more likely to encounter three-statement models and analysis around customer-level data in growth equity case studies.

In this specific case study, the company needs 60 million EUR of funding to implement a growth plan that could increase its revenue by sevenfold over five years. The case study includes questions about investment decisions, exit strategies, and downside scenarios.

The financial statement projections involve analyzing historical trends in revenue and using customer-level data to forecast revenue over five years. The income statement, balance sheet, and cash flow statement are projected based on simple historical trends. The focus is on the company’s cash position and the amount of funding needed.

The sources and uses schedule shows the primary and secondary share purchases, as well as the fees associated with the transactions. The ownership calculation is different for primary and secondary purchases, resulting in different ownership percentages.

The exit calculations are based on revenue multiples, which are determined by the growth rates and comparable company analysis. The case study provides public company comparables to determine a reasonable range for the revenue multiples.

Overall, the case study requires analysis of financial statements, understanding of ownership structures, and evaluation of exit strategies. It also emphasizes the importance of considering downside scenarios and the company’s cash position.

Related Posts

Get your FREE ebook landing page now!

2024 WordPress Landing Page Creation: Fast and Easy Guide

- The Core Technicals Guide

- Recommended Reading List

- Investment Banking Email Format

- Investment Banking Presentations

- List of IBD Diversity & Early Programs

- List of Top Investment Banks

- Activist Shareholder Letters

- Hedge Fund Presentations

- Investing Videos

- Private Equity Email Format

- Top 300 Private Equity Firms

- Financial Modeling Training

- Investment Banking Interview Coaching

- Private Equity & Hedge Fund Interview Coaching

- Credit Fund Interview Coaching

- Corporate Development Interview Coaching

- Summer Internship Return Offer Training (SIROT)

- Track Record

- Case Studies

- Client Testimonials

Full Case Study: Growth Equity

Edition: Coming Soon Author: 10X EBITDA Pages: na Original Firm: na Original Firm Peers: na Relevance: na Content: na File Format: na

Coming soon.

All of our case studies are based on the REAL exercises conducted during the recruiting process.

Our case studies are as close as it gets to the real thing..

The first thing we do when we develop a case study is to thoughtfully consider the different aspects of the original real case study. What was the company? What information was provided to the candidate? What questions did the interviewers ask during the debrief? What did the candidates struggle with? We then create mock practice case studies, tailored specifically to that firm. As a result, our cases are as close as it gets to the real thing and an excellent way for you to practice.

We specialize in recruiting and have an unparalleled placement track record.

Due to our industry experience, we’re intimately familiar with the logical reasoning and investment analysis thought process that the top buyside investment firms are looking for in case studies. Our coaching team has helped clients succeed at top private equity firms and hedge funds. Most recently, we’ve helped clients get offers from Apollo, Blackstone and KKR. We apply this expertise when crafting the case studies.

Frequently Asked Questions

Coming Soon

Privacy Overview

Why Growth Equity? How to Ace This Common Interview Question

Table of contents, understanding growth equity case studies, key elements of a growth equity case study, preparing for the growth equity case study, tips for acing the growth equity case study, real-world example of a growth equity case study.

When applying for a growth equity job, you can expect to face a growth equity case study as part of the interview process. Growth equity case studies are designed to assess your ability to analyze your ability to evaluate a business and investment decision. This process involves evaluating a company’s growth potential, identify key drivers of growth, developing strategies to capitalize on those opportunities, risks, and overall investment thesis. In this article, we’ll provide you with tips and strategies to help you ace the growth equity case study and land your dream job in growth equity.

Growth equity case studies typically involve a company that has already demonstrated significant growth, has an established product-market-fit, and is seeking additional capital to expand further. The case study will provide you with information about the company, its industry, its competitors, and its financial performance. Your task is to analyze this information and develop a growth strategy for the company.

Ace Your VC and Growth Equity Interviews!

To ace the growth equity case study, you need to understand the key elements that you’ll be expected to analyze. These include:

- Market size and growth potential

- Business model

- Competitive landscape

- Company’s unique value proposition

- Financial performance and projections

- Key growth drivers and opportunities

- Risks and challenges

- Investment thesis

To prepare for the growth equity case study, you should:

- Review the case study materials thoroughly

- Research the company and its industry (this information may be provided in the CIM)

- Analyze the company’s financial performance and projections

- Identify key growth drivers and opportunities

- Develop and investment thesis for the opportunity (i.e., why would it be an attractive investment)

- Practice presenting your analysis and recommendations

Focus on the key growth drivers

When analyzing the company’s growth potential, focus on identifying the key drivers of growth. These could include expanding into new markets, launching new products or services, or acquiring competitors. In many cases, the best opportunities have ample white space to continue growing their core business without the need to expand into other service lines. Use data and evidence from the case study to support your analysis.

Develop a compelling growth strategy and investment thesis

Based on your analysis of the company’s growth potential and the attractiveness of the business model and market, develop a compelling growth strategy that addresses the key drivers of growth. Your strategy should be specific, measurable, and achievable. Use financial projections to demonstrate the potential impact of your strategy on the company’s revenue and profitability. This ties into your overall investment laying out why you think this could be a good investment opportunity.

Be prepared to defend your recommendations

During the case study interview, you’ll be expected to present your analysis and recommendations to the interviewer. Be prepared to defend your recommendations and answer questions about your thought process. Use data and evidence from the case study and independent research to support your arguments.

Demonstrate your understanding of the industry and business model

To stand out in the growth equity case study, demonstrate your understanding of the industry in which the company operates and the business model (i.e., what the company does, how it makes money, and the value that it provides to customers). Use industry-specific terminology and cite relevant trends and market data to show that you’ve done your research.

Practice, practice, practice

Finally, the key to acing the growth equity case study is practice. Work through sample case studies and practice presenting your analysis and recommendations. Seek feedback from mentors or peers to refine your approach. Make sure to practice in a time sensitive environment, because you will typically only have 3-4 hours to complete the case.

To illustrate these concepts, let’s look at a real-world example of a growth equity case study. Imagine you’re analyzing a company that provides software solutions for the healthcare industry. The company has demonstrated strong growth over the past three years, with revenue increasing from $10 million to $25 million. However, the company is facing increasing competition from larger players in the industry, and the value proposition to the customers is not clearly defined.

In this case, you might identify key growth drivers such as expanding into new geographic markets, developing new software products for adjacent healthcare verticals, or acquiring smaller competitors to gain market share or additional product offerings. You might also identify risks and challenges, such as the need to invest in sales and marketing to maintain growth, the difficulty in continued expansion without a clear value-prop/ROI to customers, or the potential for regulatory changes to impact the industry.

Based on your analysis, you might develop a growth strategy and investment thesis that involves expanding into new geographic markets through partnerships with local healthcare providers, while also investing in new product development to differentiate the company’s offerings. Additionally, part of your thesis may include the attractiveness and overall growth and size of the market opportunity. You might also recommend acquiring a smaller competitor to gain market share and expand the company’s customer base.

When presenting your analysis and recommendations, you would use financial projections to demonstrate the potential impact of your strategy on the company’s revenue and profitability. You would also be prepared to answer questions about your thought process and defend your recommendations using data and evidence from the case study.

Another key area to diligence is the company historical performance. While the projections may seem attractive, these are projections. The historical performance is a key indicator of future performance. For example, the company may be growing nicely from a top-line/revenue perspective, but the unit economics of the business may not be compelling. If the company does not have an attractive profit margin or a clear path to improving profitability, then the investment may be risky and the company could eventually go under.

Acing the growth equity case study requires a combination of analytical skills, industry knowledge, and strategic thinking. By understanding the key elements of a growth equity case study, preparing thoroughly, and following the tips outlined in this article, you can demonstrate your potential as a growth equity investor and land your dream job in this exciting field. Remember to focus on identifying key growth drivers, developing a compelling growth strategy, and practicing your presentation skills. With dedication and preparation, you can ace the growth equity case study and take the next step in your career.

Interviewing for Growth Equity or Venture Capital Jobs?

Practice. Practice. Practice.

There are many similarities between growth equity and VC investing, and many firms will invest in both growth stage companies (i.e., growth equity) as well as earlier stage companies (i.e., venture capital). Because of the overlap between these two professions, the interview process is typically very similar as well. The best way to prepare for an growth equity or VC interview is to spend ample time preparing. First, you will need to nail down your understanding of the interview process itself and what to prepare for. Then you will need to ensure you have an in depth understanding of the investment process and responsibilities of an investor. Next, you will need to learn how to analyze a business from an investors perspective including financial modeling, returns modeling, and business diligence. Finally, you will need to work on your ability to present your findings in a clear, concise, and confident manner.

Leverage our free resources or complete VC & Growth Equity interview guide to help you prepare for all of these items.

Full interview guide

Learn how to master the interview process for for roles at top tier growth equity and venture capital firms.

Free resources

Leverage our free resources to help you prepare for the FDD interview process.

Paper LBO: A Step-By-Step Guide with Interview Examples

- Updated February 14, 2023

How To Get Into Private Equity

Preparing for private equity or growth equity interviews is quite an undertaking. Whether it’s your first interview or your tenth, there’s a lot you need to prepare.

Preparing for that first one is especially tricky, though, because you’re facing your first paper LBO exercise.

The paper LBO requires knowledge of the ins-and-outs of a leveraged buyout model, as well as strong analytical skills, knowledge of the deal, and a quick mind for mental math.

Once you know how to do it, be sure to practice – you don’t want to have the additional challenge of feeling pressured while you think.

In this article, we’ll cover what a Paper LBO model is, how to prepare, and example prompts so you can go into it feeling extremely confident.

What is a paper LBO?

At its most basic level, a paper LBO highly is a simplified LBO model that uses certain simplifying assumptions that allow you to either calculate using pen and paper (or verbally). It allows you to estimate returns for a deal quickly without a full model.

The paper LBO is not actually used much “on the job” but it is often asked for during private equity interviews (and even growth equity interviews).

In an interview situation, the interviewer will commonly ask the candidate to pencil out a paper LBO for a company or deal they’ve worked on in their previous job. In other cases, the interviewer might present a new company and supply the candidate with assumptions and financial metrics to use.

Because the paper LBO simplifies the math, usually you can complete a paper LBO using paper & pen, or verbally in an interview. Sometimes interviewers will lead you along with questions, as you complete the Paper LBO live on the fly.

Usually the paper LBO exercise will last 5-20 minutes during an interview.

Paper LBO in Interviews

Paper LBO calculations are mostly for private equity interviews , although they can show up in growth equity interviews as well.

The Paper LBO assesses many key skills for private equity and growth equity jobs and internships :

First, it’s an excellent way to quickly assess your knowledge of the mechanics of LBO modeling.

It’s also a great way for an interviewer to assess your communication and quantitative skills. Can you make quick calculations on the fly? Can you sift through financial metrics in your head and calculate orally with confidence?

Additionally, the Paper LBO allows the interviewer to dig into a deal on your resume by asking you to sketch out a Paper LBO for the deal. This allows in-depth follow up questions.

Finally, because usually the Paper LBO is requested for a company/deal you’ve worked on, it tests your level of preparation for the interviews, because in order to complete it successfully you need to remember or memorize key financial metrics for the company and deal.

Paper LBO vs full LBO model

The paper LBO you might encounter in an interview is a highly simplified version of a full leveraged buyout model.

Here are a couple key ways that paper LBO models differ from full LBO models:

- Instead of building a full 3-statement model, simply focus on projecting Revenue, EBITDA, and free cash flow every year (memorize these for the entire projection period for all your deals!)

- Since you are memorizing financial numbers for Revenue, EBITDA, and FCF, it’s OK to use figures that are rounded to the nearest $5 million

- Often, you’ll assume growth in metrics over the projection period is linear, allowing you to memorize the year 0 and year 5 metric values (and assume linear growth between them)

- No need to build out balance sheet or debt schedule; you’ll capture their impact by simply projecting FCF

Sometimes interviewers will throw in a complicating factor or two, but the calculations are all designed to be completed without a computer in less than ~20 minutes.

Step-by-step process for Paper LBO

In many ways, completing a paper LBO is the same as completing any other financial model.

For any model, you can remember the ASBICIR process. This stands for the following steps:

- A ssumptions – gather all your operating and entry assumptions (incl. pro forma valuation and debt figures); start with the purchase price and debt/equity financing split.

- S ources and uses – using the assumptions, fill out your sources and uses, which shows where the cash flows to and from in the acquisition transaction. Ultimately, this will get you to your “Sponsor Equity” which is the investment amount upon which you should base your IRR

- (Pro forma) B alance sheet – With your Sources & Uses done, you can now complete your pro forma balance sheet, and start laying the foundations for projecting it forward until the exit year. This includes setting up your debt schedule, if your modeling an LBO

- I ncome statement – next, you can start projecting forward your income statement, all the way down to net income; notably, do not yet integrate interest expense; leave this blank for now

- C ash flow – with your income statement and balance sheet up, you can project forward your cash flows. This and the prior two steps will be iterative as you set up schedules and make calculations that are interdependent on multiple statements (e.g. D&A)

- I nterest – finally, once your 3-statements are connected and projected forward, always the last step is to calculate interest expense and connect it to the income statement; turn on model iterations

- R eturns – the last step is to make an assumption about your exit, and to calculate your returns by comparing the entry investment amount to the exit investment amount

For the paper LBO, the only differences are:

- No need for B alance Sheet and I nterest Expense steps; these are both excluded; given this, you’re left with the Paper LBO short version: ASICR

- Instead of building a full 5-year projection, instead build up the model for Year 0 and Year 5 (from memory). To estimate the intervening years, you can either assume linear growth or you can use the “average” method

- To estimate the debt balance at exit (year 5), take the average of Year 0 FCF and Year 5 FCF. This will give you average FCF across all 5 projection years. Then take this number and multiply it by 5. This is an estimate of the total amount debt will decrease during the hold period

- Round numbers to the nearest $5 million

Paper LBO format

Sometimes your interviewer will give you calculation aids like a calculator or basic Excel functionality (which you shouldn’t count on).

However, most of the time your interviewer will want to hear you talk through your thought process. After all, they are hiring human talent, not a calculating robot. (AI isn’t coming for private equity – yet.)

Follow the ASICR flow above as you calculate and speak.

Plan anywhere between 5 and 20 minutes for total exercise time, both calculating and speaking.

As you practice, record yourself going through the entire thing, both to time yourself and to assess your confidence and speaking ability.

Key Assumptions Checklist for Paper LBOs

Before starting a Paper LBO exercise, it’s essential to confirm the key assumptions that will guide your calculations. Use this checklist to ensure you have all the necessary details, helping you avoid mistakes and present a solid analysis during interviews.

1. Revenue and Growth

- Starting Revenue: What is the initial revenue figure provided?

- Growth Rate: Is the revenue growing each year? If so, by how much or what percentage?

2. EBITDA and Margins

- Initial EBITDA Margin: What is the EBITDA margin for the starting year?

- Margin Stability: Are the EBITDA margins constant, or do they change over the projection period?

3. CapEx and Depreciation

- CapEx: What are the annual capital expenditures? Do they match depreciation?

- Depreciation: Is depreciation flat, or does it vary each year?

4. Working Capital

- Changes in Working Capital: Are there annual investments or changes in working capital? How do they impact cash flow?

5. Debt and Interest

- Debt Level: What is the initial amount of debt, usually expressed as a multiple of EBITDA?

- Interest Rate: What is the interest rate on the debt?

- Tax Rate: What tax rate should be used to calculate net income?

7. Exit Assumptions

- Exit Multiple: What multiple of EBITDA is used to determine the exit value?

- Exit Timing: When is the exit assumed to occur (e.g., at the end of Year 5)?

8. Free Cash Flow

- Key Components: Are all elements like EBITDA, CapEx, working capital changes, and taxes accounted for in FCF calculations?

9. Equity Contribution

- Equity vs. Debt: How much of the purchase price is funded by equity versus debt?

10. Special Assumptions

- Unique Factors: Are there any special conditions, such as non-recurring costs or specific investment requirements?

Using this checklist will help ensure that you cover all critical assumptions before starting your Paper LBO, making your analysis more reliable and easier to explain during interviews.

- 12+ video hours

- Excels & templates

PREMIUM COURSE

Become a Private Equity Investor

Paper LBO Example

This is a sample paper LBO prompt you might be given in an interview situation.

The assumptions here are pretty standard, but if there are any different ones in your interview, you will know about them. The final result of your paper LBO calculations will be the IRR and MoM for the deal.

Here’s the sample prompt:

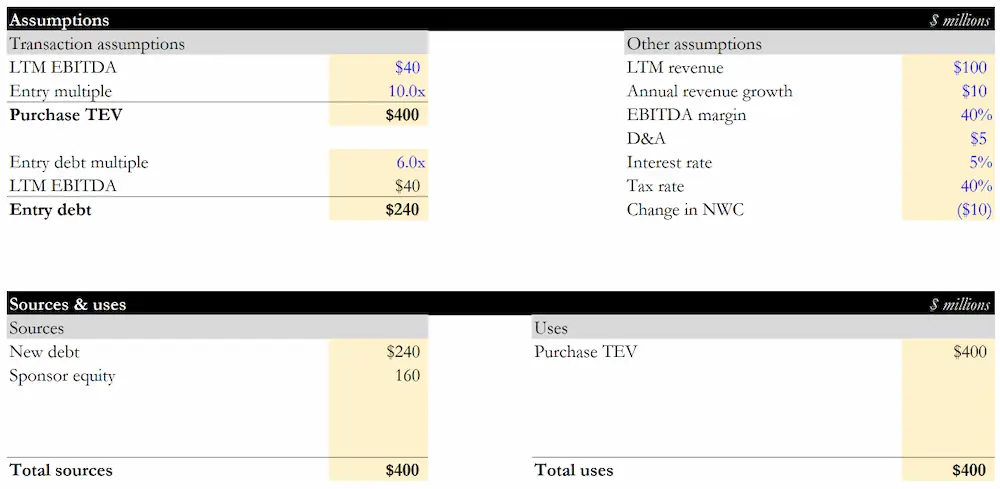

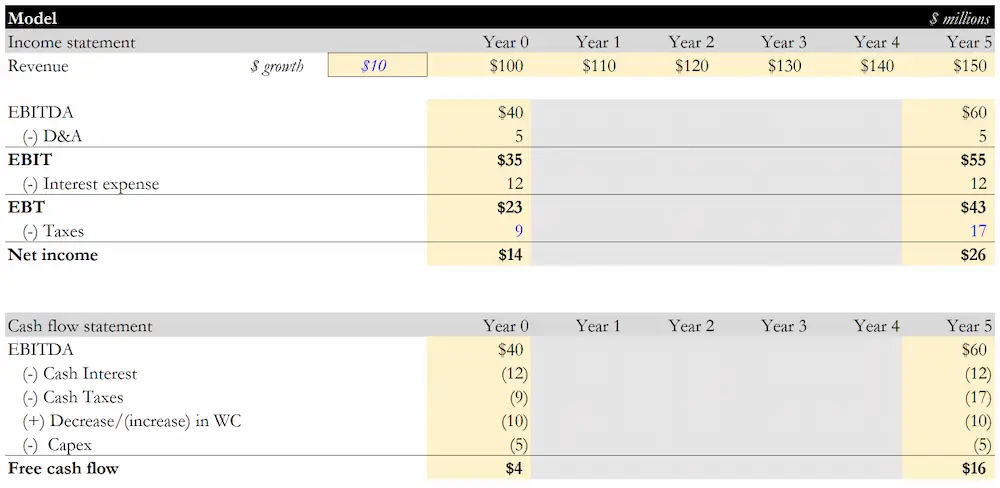

Imagine our firm is considering an LBO of Company X, and you’re on our investment team. Right now, create a paper LBO live with your interviewer to estimate the IRR and Multiple-on-Money return for the deal. Use the following assumptions: All dollar amounts are in millions. Year 0 revenue: $100 Revenue growth: $10 every year Year 0 EBITDA margin: 40% in Year 0 EBITDA margins: remain constant every year Entry timing: at end of Year 0 Entry multiple: 10x LTM EBITDA Pro forma debt: 6.0x LTM EBITDA with blended average interest rate of 5% Year 0 D&A: $5, flat across projection CapEx = D&A throughout projection Working capital: Cash investment of $10 every year Tax rate: 40% Entry timing: at end of Year 5 Assume entry-exit multiple parity

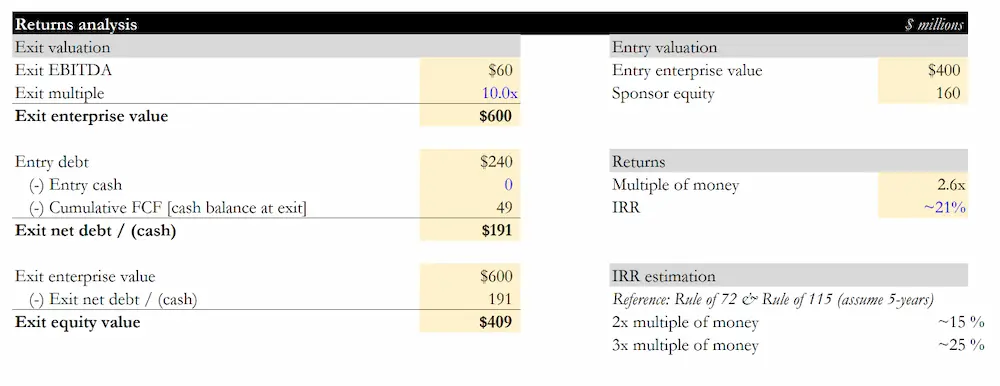

When you pencil out this Paper LBO, what IRR do you get? I get ~21% or 2.6x MoM.

Below are the key steps with outputs.

Step 1/2: Assumptions + Sources & Uses

Steps 3/4: Income & Cash flow Statements

Step 5: Returns

Special tricks for solving

- Follow the flow. The interviewer wants to see that you know how to think like an investor, and wants to see a clear, logical train of thought from beginning to end. Logical shortcuts are fine, as long as the interviewer can follow what you are doing.

- IRR is tough to calculate, but the multiple on money, or cash-on-cash return, is easy to calculate. You will need the beginning and ending equity values for the company. Then, you can use this to help you find IRR.

- Since IRR involves time value of money, it’s tricky to find without Excel or a calculator. A good rule of thumb is the Rule of 72. The Rule of 72 states that the time it takes to double your money is 72 divided by the MoM rate of return. There are also IRR tables you can memorize for common IRR values over a 5-year horizon, but the Rule of 72 has the advantage of being more flexible and easier to remember.

Common Variations and Pitfalls in Paper LBO Interviews

While Paper LBO exercises generally follow a standard format, interviewers often introduce variations or unexpected elements to test your adaptability and depth of understanding. Here’s a look at some common variations you might encounter and the pitfalls to watch out for, along with strategies to handle them effectively:

1. Variations in Assumptions:

- Variation: Interviewers may tweak key assumptions, such as revenue growth rates, EBITDA margins, or the debt-to-equity ratio, to see how you adjust your calculations on the fly.

- Pitfall: Failing to adjust interconnected metrics when a single assumption changes, leading to inaccuracies in your projections.

- Strategy: Always cross-check how a change in one assumption (e.g., lower EBITDA margin) impacts other elements like free cash flow or debt reduction. Be prepared to explain your rationale for adjustments clearly.

2. Limited or Incomplete Information:

- Variation: You may be provided with incomplete data or asked to make assumptions where information is missing, reflecting real-world scenarios where not all data is readily available.

- Pitfall: Making overly optimistic or unrealistic assumptions that could skew the results and reduce credibility in your analysis.

- Strategy: When data is missing, use conservative estimates and justify your assumptions. For example, if given no specific revenue growth rate, default to a modest industry average or historical trend.

3. Introduction of Complicating Factors:

- Variation: Interviewers might add complexities such as fluctuating working capital needs, irregular CapEx schedules, or non-linear growth assumptions.

- Pitfall: Struggling to accommodate these factors within a simplified Paper LBO framework can lead to errors or incomplete analyses.

- Strategy: Break down complex factors into manageable parts. For example, if working capital fluctuates, focus on average requirements rather than year-by-year precision. Clearly articulate any simplifications you make.

4. Changes in Exit Conditions:

- Variation: Interviewers may alter exit conditions, such as changing the exit multiple, introducing a partial exit scenario, or applying different exit timing assumptions.

- Pitfall: Incorrectly applying the exit assumptions can significantly alter the IRR and MoM calculations, which are critical to demonstrating the deal’s attractiveness.

- Strategy: Practice recalibrating your exit value calculations quickly under different scenarios. Clearly outline how each change impacts the overall returns and be ready to discuss the implications of your revised calculations.

5. Verbal-Only Walkthroughs:

- Variation: Some interviewers may ask you to conduct the entire exercise verbally without writing down calculations, testing your ability to articulate your thought process and perform mental math.

- Pitfall: Losing track of steps or becoming flustered under pressure can lead to mistakes and diminish your performance.

- Strategy: Regularly practice verbalizing your Paper LBO calculations. Develop a clear, logical script in your head, focusing on the key steps and checking your work as you go along.

Common Pitfalls to Avoid:

- Overcomplicating the Exercise: Remember, the goal of a Paper LBO is to simplify the analysis. Avoid diving too deep into granular details that aren’t necessary for the exercise.

- Rushing Calculations: While speed is important, accuracy is critical. Take a moment to double-check key figures, especially when estimating debt reduction or exit equity value.

- Failing to Communicate Clearly: Even if your math is perfect, poor communication can undermine your performance. Practice explaining your thought process clearly and concisely, ensuring the interviewer can follow along with your reasoning.

Troubleshooting Common Calculation Errors in Paper LBOs

Performing a Paper LBO under interview conditions can be challenging, and errors in calculations are not uncommon. Here’s a troubleshooting guide to help you identify, correct, and avoid common mistakes during the exercise. This guide will equip you with strategies to ensure accuracy and maintain confidence under pressure.

1. Double-Check Key Figures and Assumptions:

- Common Error: Incorrect starting figures or misremembered assumptions, such as using the wrong EBITDA margin or debt ratio, can throw off your entire calculation.

- Troubleshooting Tip: Always take a moment to verify the key inputs before proceeding with calculations. Repeat the main assumptions back to the interviewer if possible, and jot down any critical figures. This will help ensure you’re working with accurate data from the start.

2. Validate Your Revenue and EBITDA Projections:

- Common Error: Miscalculating growth rates or inconsistently applying margins, leading to inaccurate projections.

- Troubleshooting Tip: Break down the projections year-by-year, even if only mentally, to ensure growth is applied consistently. For linear growth assumptions, quickly verify that the start and end figures align with the projected annual increases. Consistency is key to avoiding compounding errors over the projection period.

3. Simplify Complex Calculations with Approximations:

- Common Error: Overcomplicating the math or trying to perform exact calculations when approximations would suffice, leading to time wastage and errors.

- Troubleshooting Tip: Use rounding and approximations to simplify complex calculations. For instance, round to the nearest $5 million or use the average method for calculating free cash flows. This not only saves time but also reduces the risk of errors creeping in through overly precise calculations.

4. Cross-Check Cash Flow Calculations:

- Common Error: Missing critical adjustments, such as working capital changes or CapEx, which can lead to incorrect free cash flow estimates.

- Troubleshooting Tip: Use a checklist approach: after calculating EBITDA, ensure you’ve subtracted D&A, CapEx, and working capital changes before arriving at free cash flow. Mentally review each step to ensure nothing has been overlooked.

5. Verify Exit Calculations and Debt Reduction:

- Common Error: Incorrectly estimating the debt balance at exit or misapplying exit multiples, resulting in flawed MoM and IRR calculations.

- Troubleshooting Tip: Re-calculate the debt reduction using average free cash flows if time allows, and ensure the exit multiple is applied consistently with the initial assumptions. A quick sense-check: compare your projected exit equity value against the entry value to see if it logically aligns with your expected return.

6. Use Mental Math Checks to Confirm Results:

- Common Error: Missteps in mental math can skew results, especially under pressure.

- Troubleshooting Tip: Utilize mental math techniques like the Rule of 72 for IRR estimation or back-of-the-envelope calculations to cross-check major results. For example, if you calculate that equity value should triple, the corresponding IRR should roughly align with doubling time in 4 years (~18%) versus tripling (~32%).

7. Manage Calculation Flow to Avoid Overlooking Steps:

- Common Error: Missing a critical calculation step, such as adjusting for taxes or correctly allocating interest expenses.

- Troubleshooting Tip: Follow a structured approach like ASICR (Assumptions, Sources, Income, Cash Flow, Returns) and mentally tick off each step as you complete it. This ensures that no critical component is missed during the exercise.

8. Recognize When to Move On:

- Common Error: Getting stuck on a difficult calculation and losing valuable time, leading to incomplete answers.

- Troubleshooting Tip: If you find yourself bogged down in a particularly complex step, summarize your approach to the interviewer and move on. It’s more important to demonstrate a complete understanding of the process than to get every number exactly right under time pressure.

Paper LBO prep plan

Private equity headhunters and interviewers alike are looking for one thing: expertise.

Since the paper LBO calculation is one of the most technical things you will cover in your interview, it is worth your while to practice. Timing yourself is also key.

Memorize key deal financials

For each of the major deals you list on your resume, memorize the following financial metrics:

- Revenue- Year 0 (entry) and Year 5 (exit)

- EBITDA – Year 0 and Year 5

- FCF (calculated from EBITDA) – Year 0 and Year 5

- Entry valuation multiple

- Exit valuation multiple

- IRR & MoM of deal

If the deal wasn’t an LBO or acquisition, you should still memorize these figures because you might be asked to pencil out an LBO for it anyway.

Memorize the Rule of 72 and Rule of 115

These will help you go from multiple on money to IRR calculations for a 5 year period.

Practice with pen and paper

If you are working from pen-and-paper case studies, see if you can get your time down to 5-10 minutes for a straightforward case study, or 10-15 for a more complex example (e.g. read more about private equity case studies ).

Practice with your deals

You can also use deals on your private equity resume to generate paper LBO calculations. Go through each deal you completed and create a paper LBO scenario.

Basically, you need to reduce the full model from the actual deal to a simplified paper calculation. Ensure that the relevant ending metrics, such as the internal rate of return and the cash-on-cash return, are the same between the original and simplified versions (within rounding error).

Since it has more meaning to you than a case study, you should be able to memorize each paper LBO scenario for previous deals. Not only will this help you become more efficient with your paper LBO calculations, but it will also make you a more confident interviewee.

Quick Reference Guide for Paper LBOs

Use this quick reference guide to streamline your preparation and boost your confidence during Paper LBO exercises. This cheat sheet condenses essential formulas, key metrics, and useful rules of thumb that are crucial for tackling Paper LBOs in interviews.

Key Formulas and Calculations

- Enterprise Value (EV): EV = EBITDA × Entry/Exit Multiple

- Equity Value at Exit: Equity Value = Exit Enterprise Value – Remaining Debt

- Free Cash Flow (FCF): FCF = EBITDA – CapEx – Change in Working Capital – Taxes

- Debt Reduction Estimate: Total Debt Reduction = Average FCF × Projection Period

Rules of Thumb

- Rule of 72: Use this to estimate the time it takes for an investment to double in value: Time to Double = 72 ÷ Annual IRR. Example: For a 20% IRR, it takes approximately 3.6 years to double the investment (72 ÷ 20).

- Rule of 115: To estimate the time for tripling an investment, use: Time to Triple = 115 / Annual IRR. Example: A 25% IRR suggests tripling in roughly 4.6 years (115 ÷ 25).

Essential Steps for a Paper LBO

- Gather Assumptions: Start with revenue, EBITDA margin, CapEx, working capital, and debt/equity split.

- Calculate Initial Equity Investment: Subtract debt from the purchase price to determine equity needed.

- Project Key Metrics: Estimate revenue, EBITDA, and FCF over the projection period using simplified growth assumptions (e.g., linear growth).

- Estimate Debt Paydown: Use projected FCF to calculate debt reduction over the hold period.

- Calculate Exit Equity Value: Apply the exit multiple to Year 5 EBITDA, then subtract the remaining debt.

- Determine Returns: Calculate IRR and Multiple on Money (MoM) to assess deal attractiveness.

Common Interview Tips

- Simplify where possible: Use rounded numbers to speed up calculations and reduce complexity.

- Communicate clearly: Always articulate your thought process, even when unsure of exact figures.

- Prioritize key drivers: Focus on metrics that significantly impact the outcome, such as EBITDA and debt levels.

Quick Mental Math Tricks

- Percent Calculations: Use approximate percentages (e.g., 10% of $100 million is roughly $10 million) to speed through parts of your analysis.

- Multiples Estimation: Quickly estimate multiples by breaking down large calculations (e.g., 8x EBITDA can be thought of as 10x less 20%).

Frequently Asked Questions

How long should a paper LBO take?

A simple case study with pen and paper provided and no complicating factors can be completed in five minutes.

A more complex calculation where Excel is allowed should not take more than five minutes either.

If the LBO study has complicating factors like multiple investors or a one-time cash outflow within the case study timeline, it can take longer, but no more than about 20 minutes including discussion time.

Are paper LBOs actually on paper?

Yes! Sometimes.

They can be on paper. Some firms may choose to do a simplified Excel version for more complex LBO examples.

Other firms may have paper or may simply do a fully verbal interview with a simpler example.

What should I do if I’m given unexpected data or assumptions during the interview?

When faced with unexpected data or assumptions, stay calm and quickly identify how these changes impact your overall model. Acknowledge the new information, adjust your calculations accordingly, and clearly communicate your thought process.

If the new data contradicts prior assumptions, explain how you will reconcile the differences. Demonstrating flexibility and a logical approach is more important than reaching the exact answer under pressure.

How should I handle incomplete or missing information in a Paper LBO exercise?

In real-world situations, data is often incomplete, and interviewers use this to test your problem-solving skills. When information is missing, make reasonable and conservative assumptions based on industry norms or historical data.

Clearly state your assumptions to the interviewer and explain why you chose them. This shows that you can navigate ambiguity and make sound decisions without all the details.

What if I’m asked to perform the Paper LBO verbally without writing anything down?

If required to perform the exercise verbally, focus on articulating each step clearly and logically. Break down your thought process into distinct sections—assumptions, projections, calculations, and conclusions—and speak through each part systematically.

Practice verbal LBOs beforehand to build confidence and refine your ability to keep calculations organized in your head.

How do I manage my time effectively during a Paper LBO interview?

Time management is crucial in a Paper LBO exercise. Start by quickly outlining the main steps you’ll take, focusing on key assumptions and calculations. Prioritize the most impactful elements—like estimating EBITDA, projecting cash flow, and calculating exit values—before diving into less critical details.

If you’re running short on time, summarize your remaining steps verbally to demonstrate your complete understanding of the process.

What are the most common mistakes to avoid in Paper LBO exercises?

Common mistakes include overcomplicating the calculations, failing to communicate your steps clearly, and neglecting to double-check key figures. Avoid getting bogged down in unnecessary details that don’t significantly impact the overall outcome.

Always keep the big picture in mind: you’re demonstrating your ability to estimate potential returns and think like an investor, not just crunching numbers.

How can I best prepare for a Paper LBO if I don’t have a finance background?

Even without a formal finance background, you can excel in Paper LBOs by mastering the basics of financial modeling and practicing regularly. Focus on understanding the key components of a leveraged buyout—purchase price, debt financing, cash flow projections, and exit valuation.

Use online resources, simplified models, and practice scenarios to build your confidence. Familiarity with mental math and common industry metrics will also help you perform under interview conditions.

What should I do if my calculations seem off during the interview?

If you realize your calculations may be off, don’t panic. Quickly identify where the error might have occurred, and if possible, correct it on the spot. If time doesn’t permit, acknowledge the potential discrepancy to the interviewer, explain how you would typically verify and correct it, and continue with your rationale.

This shows that you’re attentive to detail and proactive in managing errors, both valuable traits in finance roles.

How should I explain the rationale behind my assumptions and decisions?

Clearly explaining your assumptions and decisions is as important as the calculations themselves. Use a structured approach: state the assumption, justify it with logical reasoning or data (if available), and briefly discuss its impact on your overall model.

Be concise but thorough, demonstrating that each assumption is carefully considered and contributes to a coherent financial analysis.

Mike Hinckley

Mike is the founder of Growth Equity Interview Guide. He has 10+ years of growth/VC investing (General Atlantic, Velocity) and portfolio company operating experience (Airbnb). He’s helped *literally* thousands of professionals land roles at top investing firms.

Preparing for Growth Equity Interviews: The Ultimate Guide

How to get into private equity: an insider’s definitive guide, top saas metrics: what investors & entrepreneurs need to know, private equity operations: the complete guide, dive deeper, the #1 online course for growth investing interviews.

- Step-by-step video lessons

- Self-paced with immediate access

- Case studies with Excel examples

- Taught by industry expert

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam ever, unsubscribe at any time

Growth Equity Industry & Career Primer

Growth Equity Interview Prep

Private Equity Industry Primer

Growth Equity Case Studies

SaaS Metrics Deep Dive

Investment Banking Industry Primer

How To Get Into Investment Banking

How To Get Into Venture Capital

Books for Finance & Startup Careers

Growth Equity Jobs

GROWTH STAGE EXPERTISE

Coached and assisted hundreds of candidates recruiting for growth equity & VC

with Mike Hinckley

Premium online course

- Private equity recruiting plan

- LBO modeling & financial diligence

- Interview case studies

Register for Waitlist

FREE RESOURCES

Get My Best Growth Equity Interview Tips

No spam ever, unsubscribe anytime

IMAGES

COMMENTS

Let’s start with the elephant in the room: yes, we’ve covered the growth equity case study before, but I’m doing it again because I don’t think the previous examples were great. They over-complicated the financial model (e.g., minutiae about issues like OID for debt issuances ) and did not accurately represent a 1- or 2-hour case study.

Mar 10, 2022 · In general, case studies are often the difficult part of any private equity interview — even more so than why growth equity or other interview questions. But case studies can be especially challenging in growth equity given the wide range of case study types. In this article, I shed some light on this part of the interview and how best you ...

We don’t have a direct example here, but the VC case study on PitchBookGPT gives you a flavor of what to expect in a qualitative case. For a modeling example, see our growth equity case study based on Procyon SA. Compensation and Exits. These two points depend on whether you worked on growth buyouts or late-stage VC investments.

Growth Equity Case Studies: Lesson Overview •Part 1: What to Expect in a Growth Equity Case Study •Part 2: Historical Trends and Revenue •Part 3: Financial Statement Projections •Part 4: Sources & Uses and Ownership •Part 5: Exit Calculations and IRR •Part 6: Investment Recommendation 4 1:16 3:51 6:16 7:45 10:06 13:41

In growth equity case studies, you can expect to see similarities with venture capital case studies, such as questions about ownership and capitalization tables. However, you are more likely to encounter three-statement models and analysis around customer-level data in growth equity case studies. In this specific case study, the company needs ...

Due to our industry experience, we’re intimately familiar with the logical reasoning and investment analysis thought process that the top buyside investment firms are looking for in case studies. Our coaching team has helped clients succeed at top private equity firms and hedge funds.

To illustrate these concepts, let’s look at a real-world example of a growth equity case study. Imagine you’re analyzing a company that provides software solutions for the healthcare industry. The company has demonstrated strong growth over the past three years, with revenue increasing from $10 million to $25 million.

The Definitive Online Course for Growth Equity Case Studies & Modeling Taught by An Industry Expert. ... Case study: Paper LBO; Paper LBO example walkthrough; 4. LBO ...

Feb 14, 2023 · If you are working from pen-and-paper case studies, see if you can get your time down to 5-10 minutes for a straightforward case study, or 10-15 for a more complex example (e.g. read more about private equity case studies). Practice with your deals. You can also use deals on your private equity resume to generate paper LBO calculations. Go ...

Jan 31, 2020 · Now, this case study I should mention is a bit weird because Atlassian at the 10s of billions in market cap is far too big for traditional growth equity deal. 2 billion is much bigger than any single firm would ever commit to a deal like this in most cases.